There are a selection of concerns it is best to make when selecting a monetary establishment to work with. Do you’ve gotten any specific considerations about banks and different conventional monetary establishments? Are you extra taken with becoming a member of a cooperative? Do you require any distinctive providers that solely credit score unions or banks can supply?

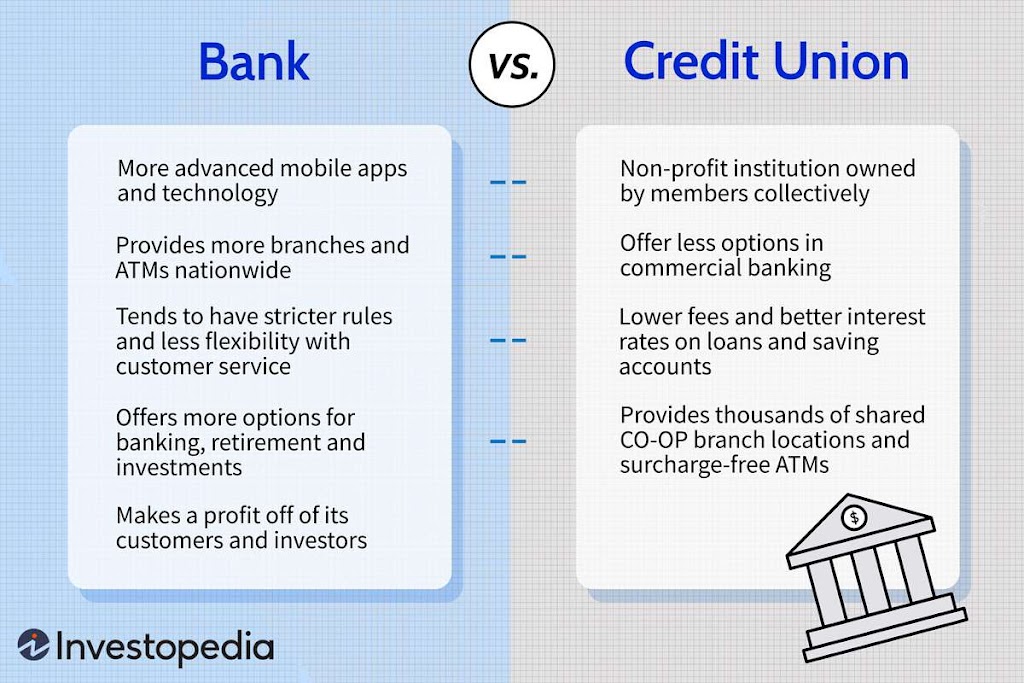

It’s important to conduct thorough analysis earlier than making any selections, whatever the scenario. Banks and credit score unions have many variations. These variations embody each their enterprise practices and the merchandise they supply. However each establishments share some traits. The advantages and disadvantages of credit score unions versus banks can be examined in additional element. banks.

Describe a financial institution.

A monetary establishment referred to as a financial institution gives its shoppers monetary providers. These embody taking deposits, disbursing loans, facilitating forex trade, supplying debit and bank cards for present and financial savings accounts, providing enterprise banking providers, disbursing loans and mortgages, and giving monetary recommendation.

Nearly all of banks cost their clients charges for his or her providers, resembling month-to-month charges, annual membership charges, or rates of interest on loans and overdraft providers, as a result of their major curiosity is in maximizing earnings. Curiosity on loans given to people, small companies, and owners is the first supply of earnings for banks. For some providers, like ATM withdrawals and overdrafts, some banks, continuously these within the US, might also cost a charge.

Clients’ deposits present the cash that banks have to function. These deposits are insured, so even when the financial institution fails, they are going to be returned. The Monetary Conduct Authority, which oversees banks within the UK and capabilities independently from the federal government, makes positive that ethical banking procedures are adopted. Within the US, banks are ruled by the Federal Reserve, an neutral group that makes positive banks adhere to morally upright banking procedures.

What precisely is a credit score union?

A monetary group that caters to its members’ wants is a credit score union. Credit score unions are members-owned, member-operated, non-profit organizations. These organizations wish to give their members entry to inexpensive monetary providers. Credit score unions, in contrast to banks, don’t want to fret about shareholders, to allow them to supply decrease rates of interest on loans and better rates of interest on financial savings. Credit score unions are identified for being friendlier than different banks. They’ve a fame for being tougher to hitch as a result of it’s a must to be a member of the group with a view to be part of the credit score union.

This allows them to supply banks decrease rates of interest and fewer charges, making them a extra upscale and cost-effective different. Credit score unions are continuously established to serve a specific demographic, resembling those that work for a specific enterprise, are in a specific occupation, or are college students at a specific establishment. Members could also be required to use for membership or could possibly be part of mechanically relying on the credit score union.

With a fast on-line search, yow will discover a ton of credit score unions in your neighborhood. Credit score unions can be found all through the US and the UK. To verify they’ve sufficient capital and are operated in a safe and sound method, credit score unions within the UK are topic to twin regulation by the Monetary Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). The Nationwide Credit score Union Administration (NCUA), a separate federal group that oversees all credit score unions with federal charters, is in command of policing credit score unions within the US.

What ought to be taken into consideration when deciding between banks and credit score unions?

The next are the primary facets to have in mind when deciding between banks and credit score unions.

Prices and Charges – The very first thing to remember is that banks continuously impose increased charges than do credit score unions. Because of the absence of shareholders who demand excessive earnings, credit score unions usually cost decrease charges. This means that credit score unions are the most suitable choice in the event you’re in search of a spot to save cash.

Rates of interest: Usually talking, banks cost increased rates of interest than credit score unions. Banks should make a revenue on the curiosity they earn from the deposits of their clients as a result of they’ve shareholders to appease. Because of not having shareholders and due to this fact not needing to make as a lot cash to achieve success, credit score unions can supply decrease rates of interest on financial savings accounts and different deposit merchandise like CDs.

Funding Prospects – Usually talking, banks supply extra funding choices than do credit score unions. There are only some investments that credit score unions should present. A few of these embody issues like certificates of deposit and cash market accounts. Nevertheless, banks are permitted to supply a wider vary of funding choices, resembling shares and bonds.

Advantages: Usually talking, banks present extra advantages than credit score unions. That is to allow them to compete with different banks for your enterprise. To do that, banks should use particular gives to entice clients. The advantages supplied by a credit score union are usually extra modest than these at a financial institution as a result of credit score unions do not make massive earnings that can be utilized for advertising and marketing.

When it comes right down to it, most individuals will base their determination on the extent of customer support they obtain when selecting between a financial institution and a credit score union. Credit score unions are famend for his or her superior customer support as a result of they’re run by a bunch of people that genuinely wish to give like-minded individuals a greater total banking expertise fairly than simply working for revenue.

What Advantages Come from Banking with Banks and Credit score Unions?

Let’s examine the advantages of utilizing banks’ and credit score unions’ monetary providers.

| Benefits of Utilizing a Financial institution | Benefits of Utilizing a Credit score Union |

| Banks are handy. They’re all over the place and simply accessible, providing all of the sorts of financial institution accounts you can ever want, and | Decrease charges. By far one of the best benefit of utilizing a credit score union is the truth that credit score unions will supply decrease, extra inexpensive charges on their monetary providers than banks. |

| Trendy banks supply a complete vary of on-line banking and fee choices. | Based on statistics, customers who use credit score unions save extra by way of their accounts. A five-year common CD for a credit score union is 0.76%, whereas it’s solely 0.63% for banks. |

| Banks are protected. Cash saved in a checking account is protected towards theft and harm, and assured by the federal government, even when the financial institution collapses. | In keeping with decrease charges, mortgage charges are far more inexpensive than they’re at banks, making them nice for customers of all types. |

| You possibly can simply lower your expenses with a checking account with straightforward account setup and straightforward transfers between your accounts. | Credit score unions are famend for being lively in native communities, whether or not that’s their bodily location or amongst their customers, due to this fact, being part of a credit score union is an effective way to put money into these communities. |

| You possibly can entry credit score simply by way of a financial institution, relying on the monetary providers they should give you. | Credit score unions aren’t for revenue and are extraordinarily customer-centric, offering an excellent expertise that places you first. |

| Disadvantages of Utilizing a Financial institution | Disadvantages of Utilizing a Credit score Union |

| The principle drawback of utilizing a financial institution is the truth that banks are for designed for-profit and due to this fact cost excessive charges and rates of interest. | Restricted accessibility. To make use of a credit score union’s providers, you could be a member, and there could also be necessities you could meet with a view to do that. |

| Banks are famend for not being very customer-centric, which means it may be difficult to get fulfilling assist in your funds and accounts as and if you want it. |